In the early stages of eSports entertainment and competition, the small group which generated the largest influence could be closely linked to its financial growth. The eSports market saw those who competed annually reaping all the rewards, which subsequently began the slow climb in the industry’s economic growth. We are now reaching a stage where stadiums are being filled, tickets are sold out months in advance, and major corporations are pouring millions into the industry in terms of sponsorships, endorsements, and advertising. With this in mind, it’s safe to assume that the hardcore gamers who competed at the grass roots level all those years ago are not the only ones boosting eSports revenue, but instead the millions of fans who tune in weekly to various tournaments, offering support in various ways.

The latest research done by leading statistics group SuperData Research shows global eSports valued at $892 million, albeit in a slowing market. While the growth of eSports may be slowing, that does not mean its financial growth is following a similar suit. The prediction by SuperData is that eSports will reach a value of $1.23 billion by 2019, and we’re on the fast track to that being a reality. There’s going to be a lot of numbers thrown around in this piece, so it’s important that you understand the difference between revenue and value when looking at the millions of dollars floating around the global eSports industry.

Revenues are predicted to surpass the $1 billion mark by next year, and that’s largely due to the aforementioned ticket sales, sponsorship, and endorsements.

According to SuperData, increased investment in eSports by publishers will help push revenues in the category past $1 billion next year, but slow growth overall will present stiff competition for them in a limited market moving forward.

There was an infographic released earlier this year where the value of eSports were spread amongst it’s three biggest regions. Asia ($328 million), North America ($275 million), and Europe ($269 million), with the rest of the world being somewhere around $19 million makes up the $892 million dollars mentioned above.

To put this in perspective, remembering that we’re now filling stadiums.

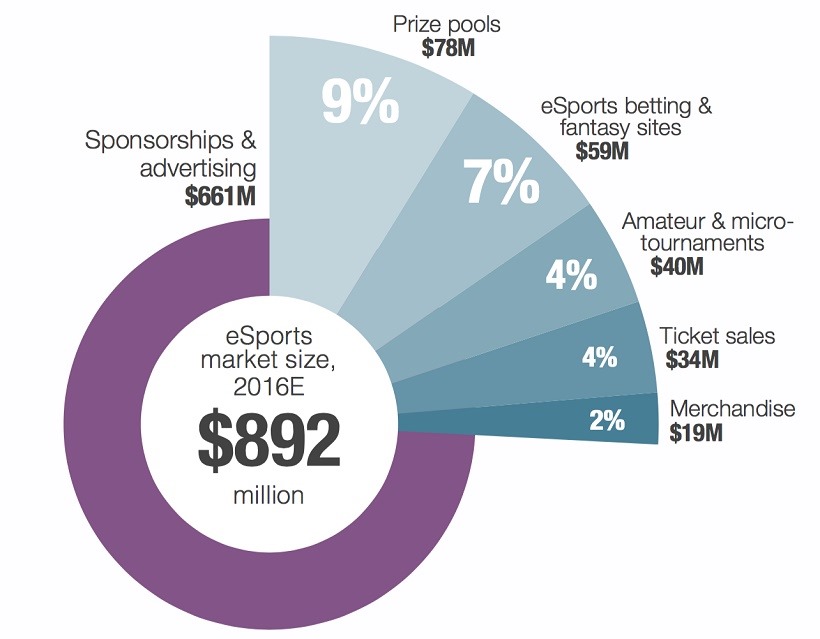

eSports today generates only 26% from direct revenue such as ticket sales and betting, though this source was up 36% year over year. 74% of revenue for eSports comes from sponsorship and advertising. According to SuperData Research, by the end of 2016, sponsorship of tournaments players and eSports related sites will reach $661 million, just 11% less than the total for the NBA in the 2014-15 season.

The increase expected over the next three years will more than likely come from an increased revenue generated by ticket sales, as the sponsorships and advertising increase in correlation. It’s clear that 2016 has been a major year for eSports as tournaments have increased in size and wealth with a number of them boasting prize pools well into the millions. The biggest influence on eSports growth comes from viewership, and that is also on the rise.

SuperData forecasts that worldwide eSports viewership will increase 14% in 2016 to an estimated 214 million and grow to more than 303 million by 2019. The growth, notes SuperData, can be attributed to the fact that eSports are not just accessible to core gamers anymore, but with popular titles such as League of Legends, Rocket League and Hearthstone also becoming eSports, the category is drawing more casual gamers.

Once again we see the influence casual gamers have on the industry’s economic growth, and this is the biggest factor when considering the future of eSports. Carter Rogers, SuperData Analyst, offered a statement regarding the current exposure of eSports on two major platforms:

“While eSports on TV will broaden the audience somewhat, it’s not suddenly going to become the main way to watch eSports.

“For longtime fans, streaming is the best way to view eSports, and they don’t need TV to ‘legitimize’ eSports.”

There are a number of titles which directly aid the growth, and these are listed below.

- Riot’s League of Legends is the world’s most-watched and highest grossing eSports title. The game generates some $737 million in revenue and registered 96 million monthly average users (MAU) from January to May 2016. Call of Duty Black Ops was second with $328 million in revenue and 26 million MAUs, and FIFA 16 was third with $256 million in revenue and 12 million MAUs.

- Rocket League’s large user base and emerging streaming community make it ripe for grassroots success moving forward. The title attracted 4 million users in July 2015, helping it build a successful streaming community and eSport fan base.

- Overwatch is poised to be the next big eSport. Blizzard’s first original IP since 1998 earned $269 million in May 2016 and secured 10 million monthly average users.

- 61% of the U.S. eSports audience is under 25 and overwhelmingly male (85%).

I somewhat dislike the term “slowing” when looking at the growth of eSports. A preferred term, for me at least, would be plateauing, but I’m not an economics major or data analyst, but we can’t argue that a word like “slowing” does come with some negative connotations. However, we cannot argue that eSports is on the fast track to reaching the predicted $1.23 billion value in 2019, and I wouldn’t be surprised if we surpass it sooner.

Like esports?

Check out esports central

Last Updated: July 21, 2016

Pariah

July 21, 2016 at 15:07

But it IS slowing. It’s about rate of growth – and having actually studied ecnomonics, slowing isn’t a negative term – it simply describes the rate of growth or decline. Now if they’d said “started to decline” then yes, negative. But growth slowing is still growth. Calling it “plateauing” would just be marketing mumbo jumbo, and I care little for twisting of words.

In fact, plateauing implies that it has reached its peak, while slowed growth still implies growth potential. So, there’s that.

Dane

July 22, 2016 at 09:37

tl;dr 30 people in a room. One day 15 of them like something, then the next day another 10 like it, it’s still positive growth because the fraction of turn-around consumers is still in proportion.