The quickest way to any big company’s heart is money and lots of it. Tech companies seem to not just be intent with you forking out a lot of your cash for their various products, but they quite literally want to control how you use your money as well. Following Apple’s move into the money and card space, comes a new report from TechCrunch that Google is looking to do the same by setting up a debit card of its own.

The project is reportedly meant to be a new centrepiece for Google’s existing Google Pay system, which currently only does online and peer-to-peer payments. By adding a psychical debit card the company is hoping to increase the reach of its payment system to more stores, retailers and restaurants. While the benefit for consumers who leverage Google’s payment platform is that they can keep everything on said platform, for Google, it means an expanded debit card presence would allow them to be more useful in keeping track of payments and purchases as well as provide the company with valuable insight on consumer spending. Something which has loads of benefits for its advertising platform, but not something which I think many customers will feel comfortable with Google tracking.

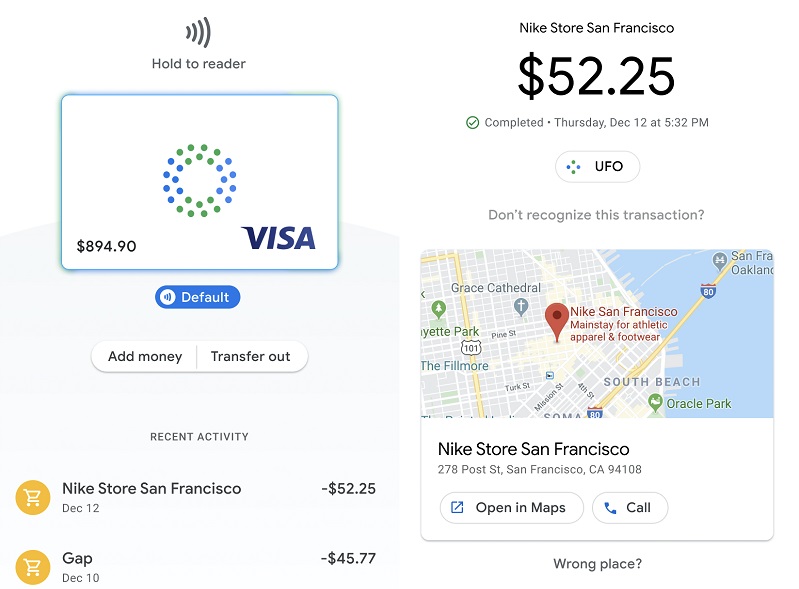

Unlike Apple’s own card — which is a full-blown credit card — the Google project is said to be a debit card only with the tech giant not planning on offering a credit feature at the moment with partners like Citi and Stanford Federal Credit Union (the card itself is a Visa card, although Google may expand that to other payment processors like Mastercard, too). Much like the Apple Card, the Google debit card is designed to work as a physical and a tap-to-pay digital card on a phone, offering a separate virtual option number for use with online retailers. The company released an official statement on the news below:

We’re exploring how we can partner with banks and credit unions in the US to offer smart checking accounts through Google Pay, helping their customers benefit from useful insights and budgeting tools, while keeping their money in an FDIC or NCUA-insured account. Our lead partners today are Citi and Stanford Federal Credit Union, and we look forward to sharing more details in the coming months.

It’s not clear yet exactly what Google will offer in terms of incentives to lure people into using their card or if they will perhaps introduce anything unique to the idea of such a payment system. With the world increasingly moving to a cashless and even cardless society, its an interesting movie from Google but one that essentially can move them closer to the money of its customers. Something which is increasingly happening for many big corporates looking to get into the payment and card business.

Last Updated: April 20, 2020