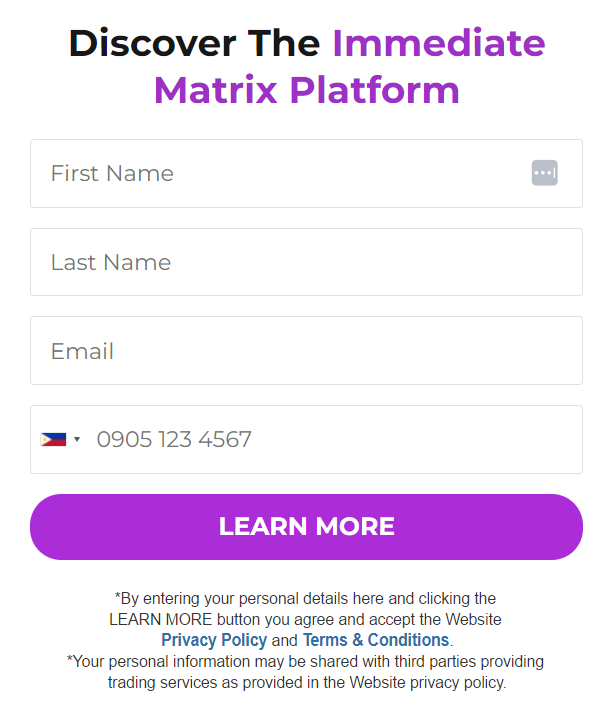

Central banks are among the most influential institutions in the global financial landscape, and their actions can significantly impact the Forex (foreign exchange) market. These institutions play a pivotal role in maintaining stability and influencing currency values. Understanding the dynamics of central bank activities in Forex markets is crucial for traders and investors seeking to make informed decisions. In this article, we will explore the vital role of central banks in Forex markets, their tools and strategies, and the influence they exert on currency trading. You can click on the image below if you are searching for a secure and reliable platform for Bitcoin trading.

Central Banks: Guardians of Monetary Policy

Central banks, often referred to as the “lenders of last resort,” are responsible for regulating the money supply and interest rates within their respective countries. They aim to maintain price stability, ensure full employment, and support economic growth. One of the primary tools at their disposal is monetary policy, which involves the management of a nation’s money supply and interest rates.

Interest Rates as a Forex Market Driver

Interest rates are a fundamental driver of the Forex market, and central banks play a pivotal role in shaping them. When central banks alter their interest rates, it can have a profound impact on currency values. Here’s how:

- Interest Rate Hikes and Currency Appreciation: When a central bank raises interest rates, it typically leads to higher returns on investments denominated in that currency. As a result, investors may flock to that currency, increasing its demand and causing it to appreciate. This can have a significant impact on Forex markets, as currency pairs are affected by the relative strength of each currency.

- Interest Rate Cuts and Currency Depreciation: Conversely, when central banks reduce interest rates, it can lead to lower returns on investments in that currency. This tends to drive investors away, causing a decrease in demand and a depreciation of the currency. Forex traders closely monitor central bank decisions for any hints of potential interest rate changes.

Interventions in Forex Markets

Central banks are not passive observers in the Forex market. They can and do actively intervene to stabilize or influence their currency’s value. These interventions are often aimed at addressing excessive volatility or addressing economic concerns. Here are some common strategies:

- Direct Currency Interventions: Central banks can buy or sell their currency in the Forex market to influence its value. For example, if a central bank believes its currency has become too strong and is hurting exports, it may sell its currency to weaken it.

- Forward Guidance: Central banks also use forward guidance to influence expectations in the Forex market. By communicating their intentions regarding future interest rate policies, they can shape market sentiment and guide currency movements.

Impact on Carry Trades

Carry trades are a popular Forex trading strategy in which investors borrow funds in a currency with a low interest rate and invest them in a currency with a higher interest rate, earning the difference in interest rates. Central banks can significantly impact carry trades by altering interest rates, which can result in abrupt changes in market dynamics.

Unconventional Monetary Policy

In times of economic crisis, central banks may resort to unconventional monetary policy measures, such as quantitative easing (more details). During QE, central banks purchase financial assets like government bonds, injecting liquidity into the financial system. This can affect Forex markets in several ways:

- Currency Depreciation: The increased money supply can lead to currency depreciation as the value of the currency is diluted. Forex traders closely watch for signs of QE, as it can lead to lower currency values.

- Risk Appetite: QE can also impact traders’ risk appetite. With central banks flooding the markets with liquidity, investors may seek higher returns in riskier assets, leading to increased volatility in the Forex market.

Influence on Economic Indicators

Central banks often release economic indicators and reports that can significantly affect Forex markets, says IMF. These reports include inflation rates, employment data, and GDP figures. Traders closely analyze these releases as they provide insights into a country’s economic health and the potential for future monetary policy changes.

Conclusion

Central banks play a pivotal role in the Forex market, with their monetary policy decisions and interventions significantly influencing currency values. Understanding how central banks operate and the impact of their actions is essential for Forex traders and investors looking to make informed decisions. Keep a close eye on interest rate changes, currency interventions, unconventional monetary policy measures, and economic indicators to navigate the dynamic world of Forex trading effectively.

Last Updated: November 22, 2023